News on Medial

Related News

Early-stage investor 2am VC floats second venture capital fund

VCCircle · 4m ago

VCCircle · 4m ago

Medial

2am VC, an early-stage venture capital firm, has launched its second fund, aiming to raise $25 million to invest in up to 30 Indian startups primarily at the pre-seed to seed stages. The fund will focus on sectors such as consumer technology, fintech, food and beverage, AI, and SaaS. Led by founders Hershel Mehta and Brendan Rogers, 2am VC plans to lead investment rounds and provide operational support to founders.

Micro VC firm Warmup Ventures floats second fund with $35 mn target

VCCircle · 7m ago

VCCircle · 7m ago

Medial

Jaipur-based micro venture capital firm, Warmup Ventures, has launched its second investment vehicle, Warmup Fund II, with a target corpus of $35.3 million. The fund will primarily invest in seed and pre-seed stage companies, with a focus on deep-tech, climate, and sustainability sectors. Warmup Ventures aims to invest in 25 to 30 early-stage startups across various sectors, providing follow-on rounds as well. The firm has already invested in more than 15 startups since its launch in 2023, including Bobabhai, Nitro Commerce, Minimizes, RocketPay, and Balwaan Krishi.

Gemba Capital launches Rs 250 Cr Fund-II

Entrackr · 1y ago

Entrackr · 1y ago

Medial

Gemba Capital, a Sebi-registered micro VC firm, has announced the launch of its second fund with a corpus of Rs 250 crore (around $30 million), including a green shoe option of Rs 50 crore ($6 million). As per Gemba, Fund-II will invest in around 30 early-stage ‘Platform-first’ businesses across fintech, consumer tech and B2B platforms with first cheque of Rs 5 crores and 30% reserve ratio for making follow-on investments. Founded in 2018, Gemba Capital invests at seed and pre-seed stage in scalable tech startups. It has backed over 120 founders across 50 startups in fintech, consumer tech and B2B platforms since its inception. Some of the notable portfolio companies arePlum (Insurtech), Grip Invest, Wint Wealth, Strata, Navadhan, Zuper, Showroom, Smartstaff, ClickPost and LightFury.

Angel Network BizDateUp Launches INR 200 Cr Fund To Back Non-Metro Startups

Inc42 · 1y ago

Inc42 · 1y ago

Medial

Angel investing platform BizDateUp Technologies has launched an INR 200 Cr Category I Alternative Investment Fund (AIF) to invest in technology startups in India. The fund will focus on startups from Tier-II and III cities, with a special emphasis on sustainability and social impact sectors. BizDateUp allows individuals to invest in Indian startups with a minimum capital of INR 1 Lakh. The platform claims to have raised over $10 Mn in the financial year 2023-24 from over 1,000 active angel investors. BizDateUp has already invested in over 25 startups from non-metro cities in the previous fiscal year.

Saudi VC Vision Ventures onboards Jordanian LP for second fund

VCCircle · 8m ago

VCCircle · 8m ago

Medial

Saudi venture capital firm, Vision Ventures, has secured a limited partner commitment from Jordan's Innovative Startups and Small and Medium Enterprises Fund (ISSF) for its second fund, Saqr Fund II. ISSF, backed by the World Bank and the Central Bank of Jordan, has committed $5m to the $90m target fund to invest in Jordanian startups. Vision Ventures has already started deploying capital from Saqr Fund II, with investments including full-stack inventory management platform for the retail industry, Rewaa. Vision Ventures focuses on sectors such as fintech, SaaS, cybersecurity, and infrastructure technologies.

Kettleborough VC launches fund II with Rs 80 Cr target, closes Rs 35 Cr in first tranche

Entrackr · 28d ago

Entrackr · 28d ago

Medial

Venture capital firm Kettleborough VC, founded by early-stage investor Nisarg Shah, has launched its second fund with a target corpus of Rs 80 crore and announced a first close at Rs 35 crore. The fund is backed by a mix of family offices and entrepreneurs from India and the US. According to Kettleborough, Fund II will continue to invest in deeply experienced founders at the earliest stages, typically those with over 10 years of domain expertise and a strong execution focus. The firm will write initial cheques of $300,000–$500,000 in about 10 startups, with significant follow-on reserves for high-performing bets. Founded in 2021, Kettleborough VC has built a name as a conviction-led, construct-specific fund. Its Fund I backed 12 startups including Zippmat, InPrime, Finhaat, and Elivaas, nine of which received their first institutional cheque from Kettleborough. These portfolio companies have since raised follow-on rounds from investors like Omnivore, Lightspeed, 3one4, and Bessemer. “We only back founders for whom the startup is a natural outcome of a decade-long journey in their domain. Fund I has validated this thesis with strong portfolio traction and early PMF. Fund II doubles down on this conviction,” said Shah. Kettleborough added that it focuses on “Dhandha-first” businesses, with interest across financial services, commerce infrastructure, and vertical SaaS/AI platforms. Shah has personally backed over 30 startups, with 10 exits and 80 follow-on rounds, including hits like Foxtale, Onebanc, and Homeville.

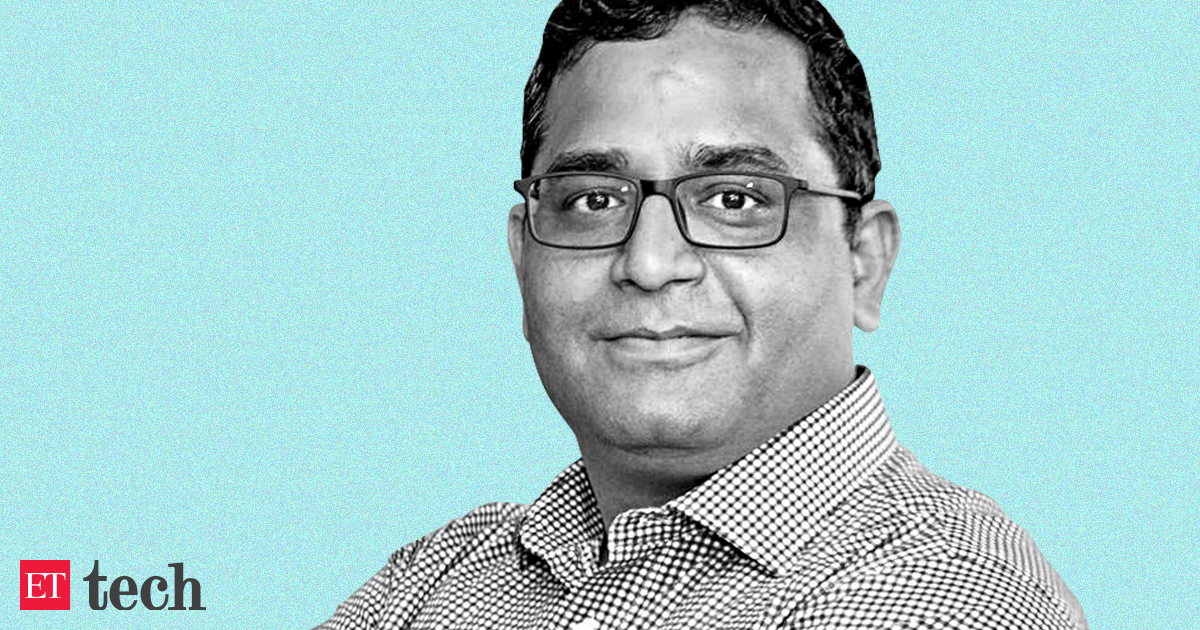

Paytm's Vijay Shekhar Sharma launches maiden fund with target corpus of Rs 30 crore

Economic Times · 1y ago

Economic Times · 1y ago

Medial

Paytm's chairman, Vijay Shekhar Sharma, has launched a Rs 20 crore category-II alternative investment fund (AIF) called VSS Investments Fund, with an additional green shoe option of Rs 10 crore. The fund will focus on backing startups in new frontier technologies, including artificial intelligence (AI) and electric vehicles. Sharma is expected to be one of the primary contributors to the fund. The AIF will invest in Indian startups working on products and services for domestic customers, particularly in advanced technology and AI-driven innovations.

Hyderabad Angels Fund launches Rs 150 Cr VC fund

Inshorts · 1y ago

Inshorts · 1y ago

Medial

Hyderabad Angels Fund has launched its inaugural venture capital fund, classified as a Category 1 AIF, with an initial investment pool of Rs 100 crore along with an optional additional greenshoe of Rs 50 crore. The fund will be tailored for tech and AI-driven startups prioritising scalability. It aims to invest up to Rs 5 crore each in 20 startups.

Early-stage VC firm Veda VC makes first close of Rs 250Cr fund

/indianstartupnews/media/agency_attachments/s1FnhAYONODoxNkoC8xA.png) IndianStartupNews · 1y ago

IndianStartupNews · 1y ago

Medial

Veda VC, an early-stage venture capital firm, has achieved the first close of its Rs 250 crore ($30 million) fund, led by family offices and startup CXOs. The SEBI-registered fund will invest in Indian tech and tech-enabled startups, focusing on consumer internet, SaaS, fintech, and deeptech sectors, with investment sizes ranging from $250,000 to $1.25 million. Veda VC aims to support portfolio companies with not only capital but also domain expertise, network, and execution skills. The Bengaluru-based firm, founded in 2019, has already invested in 46 startups, several of which received follow-on funding from notable investors.

Lavni Ventures launches Rs 200 crore fund to invest in India's deeptech startups

/indianstartupnews/media/agency_attachments/s1FnhAYONODoxNkoC8xA.png) IndianStartupNews · 1d ago

IndianStartupNews · 1d ago

Medial

Lavni Ventures, a Bengaluru-based venture capital firm, has launched a Rs 200 crore deeptech impact fund called Lavni Fund II. The fund targets climate, healthcare, energy, and education startups, aiming to help Indian deeptech enterprises scale globally while delivering social and environmental benefits. Lavni Ventures specializes in early-stage medtech, edtech, cleantech, and agritech investments. Fund II will provide seed to Series A funding, along with mentorship and industry connections, to promising startups.

Download the medial app to read full posts, comements and news.