Back

Tarun Suthar

•

The Institute of Chartered Accountants of India • 6m

i don't think so, he may told you the eligibility period since incorporation. You can avail tax benefits for 3 consecutive years. but the startup must claim the tax exemption within the first 10 years of its incorporation.

Replies (1)

More like this

Recommendations from Medial

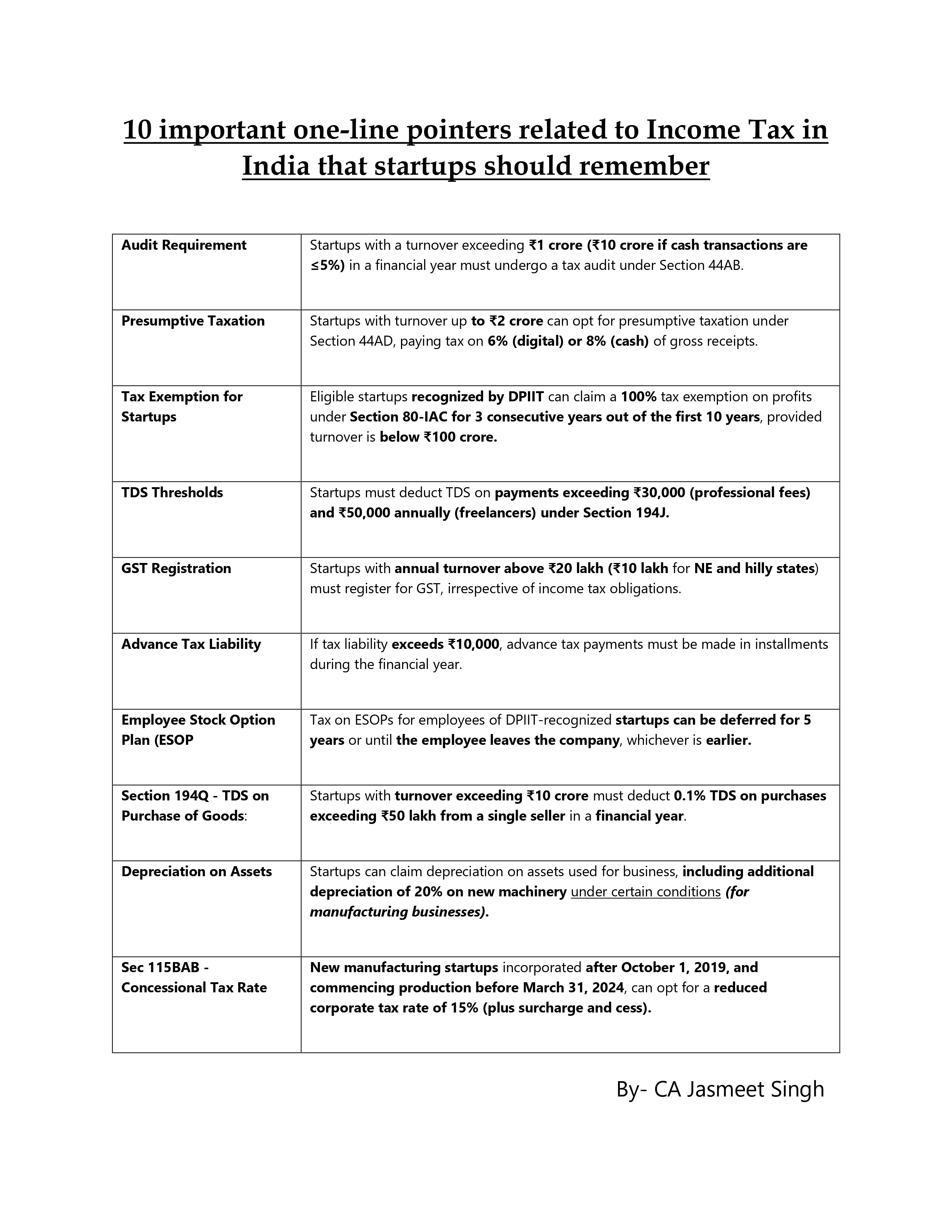

CA Jasmeet Singh

In God We Trust, The... • 4m

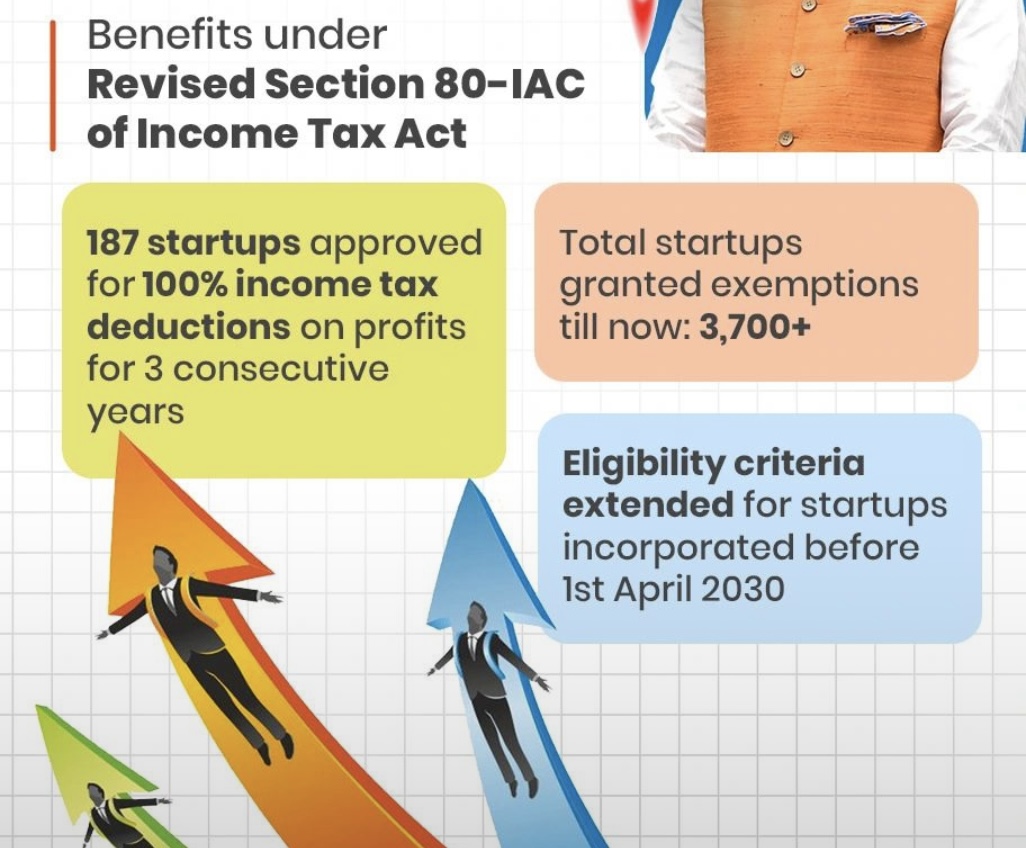

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

CA Chandan Shahi

Startups | Tax | Acc... • 4m

Big Relief for Start-Ups! 🚀 The Finance Act 2025 brings great news for aspiring entrepreneurs! The tax exemption under Section 80-IAC—which allows eligible start-ups to claim a 100% deduction on profits for three consecutive years within their firs

See MoreNawal

Entrepreneur | Build... • 6m

Reality of startup india scheme Core Features of the Startup India Initiative according to the Government of India: Ease of Doing Business: Simplified compliance, self-certification, and single-window clearances streamline processes for startups.

See More

Shiva Prasad

Passionate Software ... • 1y

Hi Guys, I want to know few things about below mentioned points 1. Will we invest in startup(Starting from 2,000 rupees) and become a share holder if you like it? 2. What are the benefits we get, if we invest in Startups? 3. Any tax exemption

See MoreAccount Deleted

Hey I am on Medial • 4d

Startup Recognition in India ' (under DPIIT – Department for Promotion of Industry and Internal Trade) 🎁 . Benefits After DPIIT Recognition: Tax exemption for 3 years under section 80IAC. Exemption from Angel Tax under section 56(2)(viib). Easie

See MoreSandip Kaur

Hey I am on Medial • 11m

Essential Tax Tips Every Indian Startup Shld Know- Navigating taxes can be tricky for startups, but mastering them is crucial for growth. Here’s what every Indian entrepreneur shld keep in mind: •Startup India Exemptions: If your startup is recognize

See MoreDownload the medial app to read full posts, comements and news.